Understanding Travel Nurse Per Diem Rates

Considering becoming a travel nurse, but confused about how you will be paid? Travel nurse pay packages are understandably confusing, but once you grasp the concept you can use it to your advantage to maximize your take home pay.

Do you have questions on how to handle taxes or are you confused about stipends and reimbursements? You aren’t the only one! A common question amongst travelers is how do travel nurse agencies come up with travel nurse per diems. Believe it or not, there is a science (and Federal regulations) behind the rates for housing, meals, and incidental expenditures on your travel contracts.

Read the following to find out what travel nursing agencies mean by per diem rates and how decisions are made for the amount you will receive towards lodging, meal, and incidentals expenses.

What is Meant by Per Diem in Travel Nursing?

The term per diem has two meanings in the nursing world. Per diem comes from the Latin term meaning “per day” and is also commonly referred to as being “on call” which can be quite confusing for nurses trying to navigate travel nurse pay.

For the purpose of this blog, per diem will be used to refer to the two classifications for per diem rates that travel nurses receive. Per diems include lodging and meals and incidental expenditures (M&IE) for when you are traveling away from home. Lodging rates are often referred to as housing stipends to avoid any confusion.

Per diems are typically offered as part of a stipend package for travel nurses. Even though most staffing agencies set their rates, there are federal guidelines that agencies need to follow for per diems. Most travel nurses qualify for a per diem daily amount to be added to their pay for meals & incidentals and housing during their travel assignment.

To qualify for tax-free stipends or reimbursements, nurses must maintain a tax home or a place of residence that you maintain while they are away on a travel assignment.

If you choose not to maintain a “permanent” residence or tax home, you are considered an itinerant worker and be responsible for taxes on your income and stipends.

Make sure you communicate with your recruiter about your tax home status. Your recruiter and our credentialing specialists will help determine if you qualify for per diems. You will be required to complete a worksheet to determine eligibility.

How to calculate the Per Diem Rate?

The General Services Administration (GSA) establishes per diem rates for destinations within the Continental United States (CONUS). This system was initially used for Federal government employees. Its use has expanded widely and is now the standard for rates allowable for all types of non-government employees including healthcare travelers and private citizens who travel away from their tax home to work. The State Department sets the rates for foreign countries separately.

Years ago a staffing agency might pay a low hourly rate and give the rest as extra money in tax-free reimbursements putting the agency and travel nurse at risk for financial penalties with the IRS.

Standardizing tax-free stipends helps to avoid confusion and makes sure nursing agencies follow regulations and offer the same rates and a reasonable wage that would be accepted under normal circumstances by someone in the same profession from one facility to another.

CONUS per diems include non-standard or standard CONUS locations. Non-standard areas (NSAs) are frequently traveled by the federal community and are reviewed on an annual basis. Standard CONUS locations are less frequently traveled by the federal community and are not specifically listed on the GSA web site. Currently, the standard CONUS per diem rate is $96 for lodging, $59-79 for meals and incidental expenses, with minimal increases expected for lodging in 2023.

The GSA website allows you to enter your travel destination and see column-by-column breakdown of per diem rates in each county in that state. Daily lodging is broken down by month, and meals and incidentals are categorized per expense. For example, the M&IE current total for Philadelphia is $79 per/day. It is further broken down into breakfast $18, lunch $20, dinner 36$, incidental expenses $5, and first and last day of travel $59. If you are researching travel assignments, use the GSA tool to find out expenses and per diem rates, for the area, you are considering.

To calculate the maximum reimbursement allowed for lodging or M&IE, multiply the provided figure by the number of days. To determine your weekly total, multiply the daily value by 7. Multiply the daily total by the number of days in a month to calculate your monthly total. You can look up an area and determine the maximum per diem allowable for your desired destination online here.

Health Carousel Travel Nursing takes every step possible to comply with all Federal regulations regarding our travel nurse’s pay packages including per diems. This protects you personally and our organization as well.

Rest assured HCTN follows all guidelines and will not put your long-term financial stability at risk for short- term, tax-free gains. Contact us to discuss your next travel assignment!

Ready for your next travel assignment? Work how you want and where you want, faster, when you travel with us. Get submitted quickly to top travel nurse jobs and be first in line for an interview.

Contact one of our travel nurse recruiters today!

FAQs

What if I want to travel full-time and not keep a permanent home?

As a travel nurse, you have the freedom to travel as much as you want. Some nurses may prefer to keep a permanent home that they return to in between assignments, while others choose to live more of a nomad life and make their “home” wherever the current assignment is. Either one of these is a perfectly acceptable option, the difference will be that if you have a “tax home” or permanent home that you are committed to maintaining financially then your per diem benefits will be tax-free. If you choose not to have a tax home, than you will be subject to paying taxes on any received stipends. Did you know you can be a local travel nurse? Find out more here.

Author Bio

Lauren Rivera is a nationally certified neonatal intensive care nurse with over 15 years of experience. She serves as a nurse expert offering support and educational classes for women from preconception through childhood. Lauren is also a freelance writer with works published on several nursing sites. She develops and curates content for various healthcare companies, and writes continuing education modules for other healthcare professionals.

GET STARTED IN

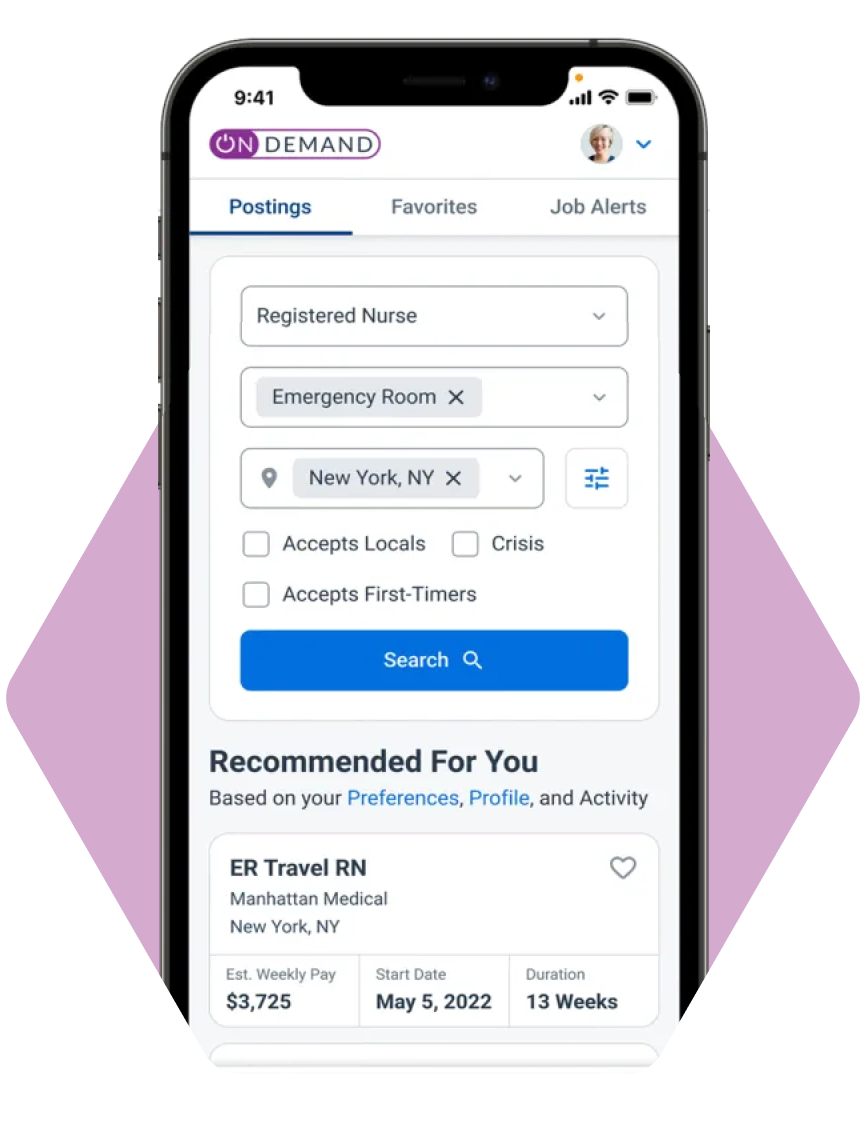

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

View Top Jobs in

Search, apply and be the first in line for your dream job today.

View Top Jobs in

Search, apply and be the first in line for your dream job today.

Apply to Top Jobs in

Search, apply and be the first in line for your dream job today.

Get Started in

Search, apply and be the first in line for your dream job today.

Take Control of Your Career with

Search, apply and be the first in line for your dream job today.